The enchancment in inflation expectations stalled in April they usually stay above the Turkish central financial institution’s disinflation path, thus necessitating sustaining a decent and decisive financial coverage stance, in response to the financial institution’s governor on Saturday.

Speaking on the two-day summit organized at Boğaziçi University in Istanbul, Central Bank of the Republic of Türkiye (CBRT) Governor Fatih Karahan evaluated current developments in international and home markets, macro outlook and inflation expectations.

“Due to developments in the financial markets in recent times, the improvement in inflation expectations stalled in April. Inflation expectations continue to stay above our disinflation path. This outlook necessitates maintaining our tight and determined stance in monetary policy,” the governor mentioned.

The inflation in Türkiye dropped to 37.9% in April, down from 38.1% in March, in response to the official figures from the Turkish Statistical Institute (TurkStat). Annual inflation exceeded 75% in May 2024, earlier than beginning to gradual in June amid aggressive financial tightening.

The Turkish central financial institution hiked its charges via an extended cycle that kicked off in the summertime of 2023 and step by step started reducing them in December final yr as inflation continued to ease. It minimize it to 42.5% in early March, earlier than reversing the cycle final month with a shock 350-basis-point price hike to 46%.

The financial institution hiked the speed amid volatility following the arrest of Istanbul Mayor Ekrem Imamoğlu on corruption prices pending a trial, and uncertainty about U.S. tariffs.

Global uncertainty

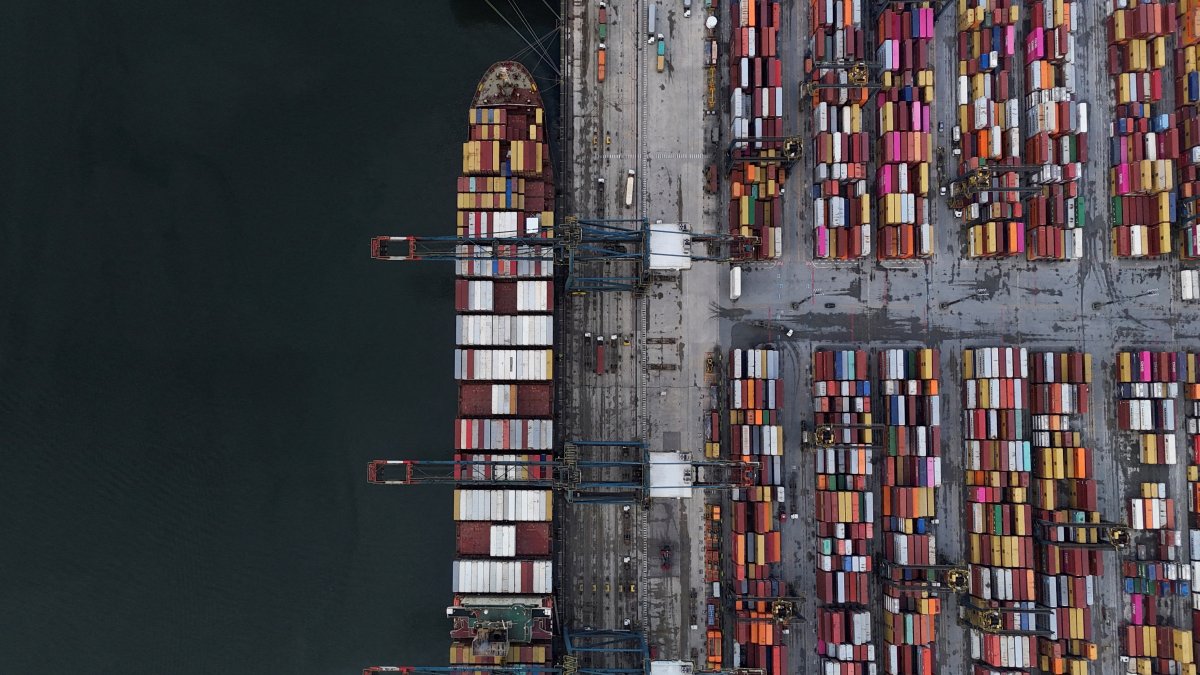

Related to fluctuations globally, Karahan said that though a good portion of the current tariff choices have been postponed, uncertainty concerning international commerce and financial insurance policies stays excessive. He urged that volatility indices are excessive throughout this era, as ups and downs are noticed in international inventory markets.

“These changes in asset prices increase macrofinancial risks on the balance sheets of financial institutions. These uncertainties increase downside risks to global growth, while there are possible effects on inflation that vary from country to country,” he mentioned.

Referring to the financial coverage practices in Türkiye and up to date macroeconomic developments, Karahan summarized the instruments they use to assist the tight financial stance in three principal teams.

“With the arrangements regarding deposits, we aim to increase the share of Turkish lira deposits and gradually reduce the KKM (FX-protected scheme). With the arrangements regarding credit growth, we prevent fluctuations in credit demand. Thirdly, with our steps regarding liquidity, we manage the excess Turkish lira liquidity in the system,” he famous.

Since March, they’ve additionally assessed the potential dangers that current developments in monetary markets could pose to the inflation outlook and have taken steps to extend financial tightening, Karahan mentioned.

Inflation, meals costs

Furthermore, pointing to the decline in inflation, he mentioned that each the common of the six indicators they use and the median inflation, which has comparatively good forecasting efficiency, “imply that annualized inflation is just above 30%.”

“This indicates that disinflation will continue,” he added.

Additionally, he evaluated the meals costs, noting that when wanting on an annual foundation, they proceed to fall however have witnessed an uptick in March attributable to Ramadan, after which recorded a extra average improve in April.

“However, the agricultural frost that occurred throughout the country last month increased the upward risks on unprocessed food prices, especially fruit, for the upcoming period,” he continued.

At the identical time, he attributed a constructive influence of commodity costs on disinflation, in addition to weakening home demand.

“Commodity prices contribute to disinflation by moving more moderately; foreign demand is weakening. Domestic demand is also weakening thanks to the measures we have taken in monetary policy,” Karahan mentioned.

“On the other hand, considering that uncertainties are higher than in the past, we are exhibiting a cautious and tight monetary policy stance. Our tight monetary policy stance will continue until a permanent decrease in inflation and price stability is achieved,” he concluded.

Turkish central financial institution, later this month, is ready to carry a briefing on the second inflation report this yr to offer recent updates on inflation and the coverage path.

Source: www.dailysabah.com