A broad rise in costs, from espresso and audio gear to dwelling furnishings, pushed U.S. inflation larger in June, which economists view as an indication that the Trump administration’s escalating import tariffs are being handed on to customers.

Overall shopper costs rose 0.3% in June, a roughly 3.5% annual charge, after a 0.1% improve in May, official knowledge confirmed on Tuesday.

Economists – and Federal Reserve (Fed) officers – say they have been anticipating inflation to assemble tempo this summer season because the lagged influence of tariffs will get handed alongside by companies, and the June knowledge recommend central financial institution policymakers specifically might stay reluctant to chop rates of interest till extra data is at hand.

The tariff worth shock may finally show a short lived, one-time adjustment. But with the ultimate tariff ranges nonetheless being thought of by President Donald Trump, and steeper levies threatened as of Aug. 1, the inflation outlook stays unsettled.

The newest knowledge “showed that tariffs are beginning to bite,” mentioned Omair Sharif, head of Inflation Insights, “apparel prices rose, household furnishing prices jumped … and recreation commodities increased.”

Those are closely imported objects and the will increase have been substantial.

Prices for audio-video gear rose 1.1% over the month and have risen 11.1% on a year-over-year foundation, the biggest bounce ever in a class the place globalization had usually meant regular or falling costs.

It will probably strike a word of warning for the Fed, which has been dealing with virtually every day criticism from Trump for not reducing rates of interest, a step central bankers have been reluctant to take till it’s clear the place the tariffs will go away the U.S. economic system.

Yields on U.S. Treasury securities rose to their highest in a couple of month, and rate of interest futures mirrored rising uncertainty that the Fed would resume charge cuts in September, with a mannequin from CME Group displaying that call was seen as a close to toss-up after being the baseline expectation for the previous month or so.

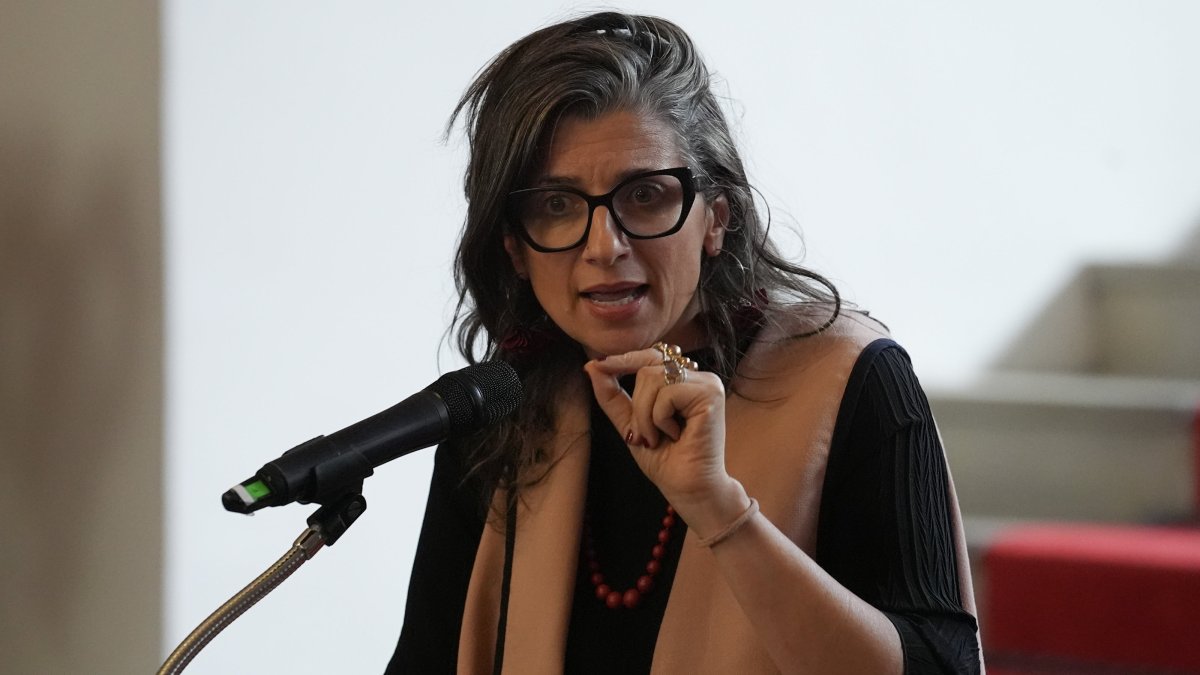

In a speech in Washington on Tuesday, Federal Reserve Bank of Boston President Susan Collins warned that she continues to count on the rise in import taxes to push up inflation whereas pushing down development and employment. But she added that sturdy stability sheets on each the business and family sides might assist take in the hit and reduce its influence.

“The impact of tariffs may be lessened somewhat by an ability for firms to decrease profit margins and for consumers to continue spending, despite higher prices. As a result, the adverse impact of tariffs on labor market conditions and economic growth may be more limited,” Collins mentioned.

Trump on social media mentioned that shopper costs have been “LOW” and repeated his name for the Fed to chop charges. The shopper worth degree was about 1.2% larger in June in comparison with December, the final full month earlier than Trump began his second time period.

White House Press Secretary Karoline Leavitt mentioned the truth that core inflation, which excludes meals and power costs, elevated lower than anticipated, “proves that President Trump is stabilizing inflation.”

Core inflation elevated at a 2.9% annual charge in June, barely beneath the three% consensus forecast, however barely sooner than in May. Food and power prices each elevated, pushing headline inflation as much as 2.7% from 2.4% the month earlier than.

“With increases in categories like household furnishings, recreation, and apparel, import levies are slowly filtering through,” wrote Seema Shah, Chief Global Strategist at Principal Asset Management. “It would be wise for the Fed to remain on the sidelines for a few more months at least.”

Investors nonetheless count on the Fed in September to chop 1 / 4 of a proportion level from the present 4.25% to 4.5% benchmark rate of interest maintained since December, however odds of a minimize on the upcoming July 29-30 assembly are actually beneath 5%.

Powell had earlier pinpointed this summer season because the time when the U.S. central financial institution will study if inflation is responding to the tariffs utilized on buying and selling companions and varied industrial sectors.

So far, the levies have had solely a restricted influence on inflation, however economists broadly have anticipated to see them finally filter into retail costs.

“We know there is a lag between implementation and the inflationary effect,” mentioned Gregory Daco, chief economist at EY-Parthenon. “Businesses manage imports using different processes … We have not seen the full-blown effects of tariffs on CPI data … I would expect to start to see more.”

Clawing again tariff prices

The June CPI knowledge will probably go away the Personal Consumption Expenditures Price Index the Fed makes use of for its 2% inflation goal nicely above that purpose, with elevated uncertainty now that Trump has threatened tariff ranges of 30% or extra on Mexico, Canada and the European Union, and extra actions are all the time doable.

The PCE index outdoors meals and power rose at a 2.7% annual charge in May; latest Fed policymaker projections see it hitting 3.1% by the tip of 2025; and the newest spherical of tariffs threatened by Trump for Aug. 1 may push it even larger.

The new tariff charges, “if fully passed through, would add about 0.4 percentage points to the PCE price level,” Michael Feroli, chief U.S. economist at JPMorgan, estimated. “Given imperfect pass-through, margin compression, a more likely estimate is 0.2-0.3 points. We think this bolsters the case for the Fed to take a very cautious approach to rate cuts.”

Daco mentioned there was already “divergence” starting throughout a large swath of products the place costs are rising sooner than they did earlier than Trump’s preliminary rounds of tariffs.

The worth of family furnishings, for instance, jumped a full proportion level in June. Prices of these merchandise had been dropping, however reversed course within the spring.

Other economists have pinpointed totally different objects that might present the place the brand new import taxes are beginning to hit shopper costs.

Sharif, the top of Inflation Insights, mentioned the broad class known as “recreational commodities,” which incorporates issues like toys and audio and visible gear which are usually imported from China, bears watching – and rose 0.8% in June, twice as quick as within the previous two months.

Outdoor gear and instruments are additionally objects which are closely imported, and whereas the tempo of worth will increase had picked up within the spring, it fell again in June to 0.2% versus 0.6% in May.

Still, “tariff costs are strikingly visible in June’s CPI data,” wrote Samuel Tombs, chief U.S. economist for Pantheon Macroeconomics. Excluding autos, costs for different non-food or power items rose on the quickest tempo since June 2022, when the Fed was nonetheless in a battle to decrease pandemic-era inflation.

“Prices rose especially sharply for goods which are primarily imported,” with costs for home equipment, sports activities gear and toys all rising practically 2% on the month, he mentioned.

Source: www.dailysabah.com