Trade between Türkiye and Russia has chilled amid a U.S. risk to hit monetary corporations doing business with Russia, disrupting or slowing some funds for each imported oil and Turkish exports, in accordance with seven sources acquainted with the matter.

The U.S. govt order in December didn’t explicitly goal vitality but it surely has difficult some Turkish funds for Russian crude in addition to Russian funds for a broader vary of Turkish exports, the sources stated.

U.S. sanctions intention to cut back the Kremlin’s income and disrupt its battle in Ukraine with out choking Russian oil flows to international markets, to keep away from a politically delicate leap in U.S. gasoline costs with President Joe Biden searching for reelection in November.

However, comparable fee issues to these now confronted by Türkiye have already disrupted Russian oil provides to India and complex these to the United Arab Emirates (UAE) and China, in accordance with oil merchants.

Russia is the highest crude and diesel exporter to Türkiye, supplying 8.9 million metric tons of crude and 9.4 million tons of diesel to its Black Sea neighbor within the 11 months to November.

The rising fee points are as a result of Turkish banks reviewing business and tightening compliance with Russian purchasers, 4 of the sources stated. They haven’t disrupted Türkiye’s crude provides, delaying solely a small variety of cargoes, two oil trade sources stated.

A supply with a Russian oil main stated Russian oil exporters haven’t obtained funds from Türkiye for 2 to a few weeks.

“It has become difficult to make some energy payments to Russia, especially after the new sanctions (threat) at the end of December. Some payments were disrupted,” a Turkish supply acquainted with the funds challenge stated.

“The originally agreed upon method had to be changed or the payment had to be postponed, but the shipment continued. There may be problems on a cargo-by-cargo basis,” the supply stated.

The industrial and monetary sector sources mentioned the fee and commerce disruption below the situation of anonymity given they aren’t licensed to discuss the delicate matter.

“Payment issues began after December. The focus is not on oil imports, but it is unsettling. It has not impacted day-to-day functioning but reminds us that a problem could arise any time,” a Turkish oil trade supply stated.

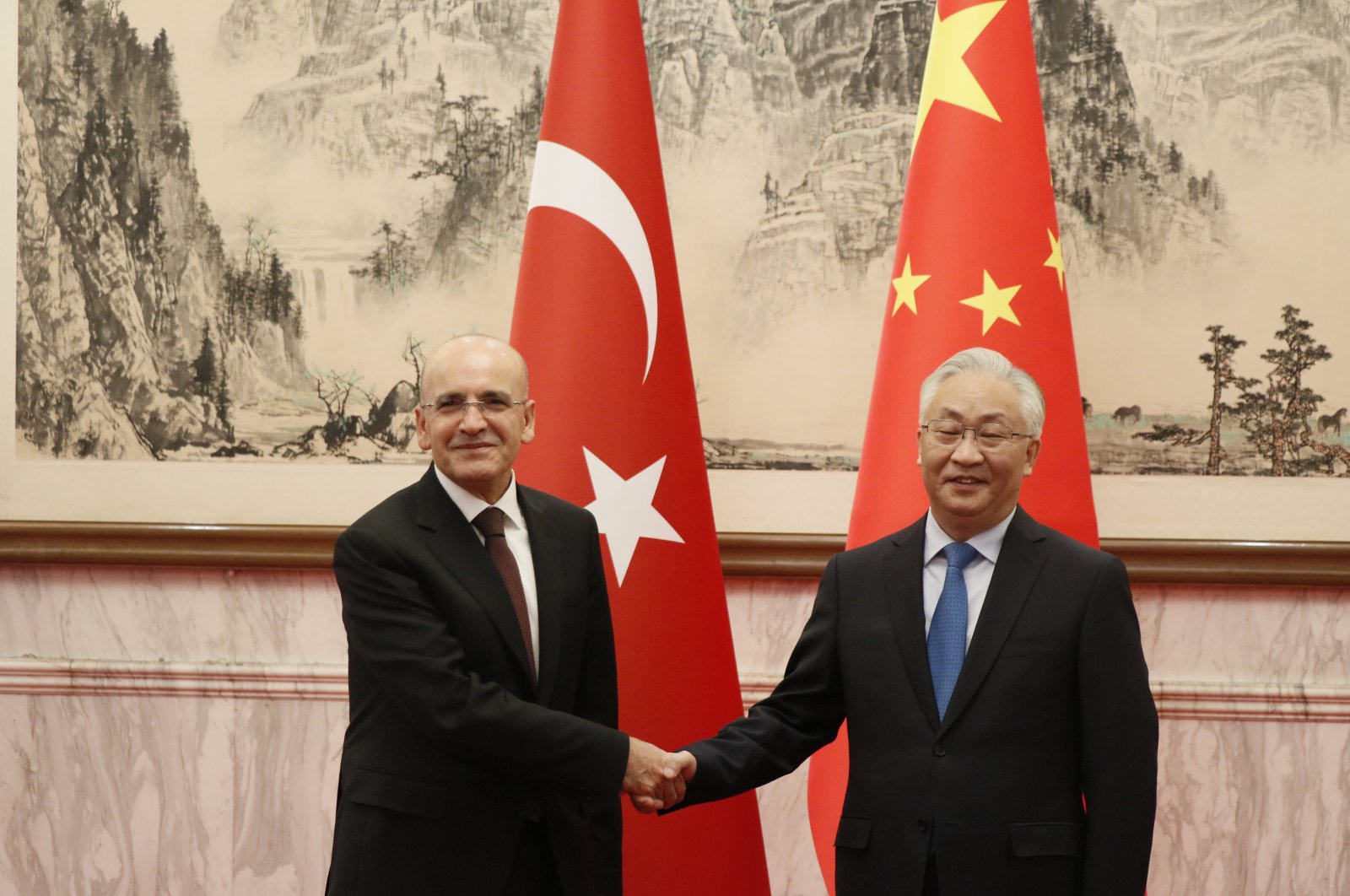

Ankara opposes Western sanctions on Moscow however has criticized Russia’s invasion of Ukraine two years in the past. It has managed to take care of shut ties with each Moscow and Kyiv all through the battle.

Ankara has repeatedly vowed that the sanctions is not going to be circumvented on Turkish soil.

Washington has sought to halt the transit of dual-use items that Russia might use on the battlefield and has warned that Turkish banks and corporations might be hit by secondary U.S. sanctions.

‘Extremely meticulous’

The disruption to Russian-Turkish funds started when Biden signed the manager order on Dec. 22 threatening corporations serving to Russia circumvent sanctions with the danger of shedding entry to the U.S. monetary system.

Financial establishments doing business on behalf of these focused by U.S. sanctions are in danger, the order stated.

On Feb. 1, the Kremlin stated it was conscious of Turkish banks tightening guidelines on Russian purchasers as a result of “aggressive” U.S. stress, and that it was working with Türkiye to seek out options.

Central Bank of the Russian Federation Governor Elvira Nabiullina stated on Friday that there have been extra difficulties in international commerce transactions associated to settlements and logistics.

One Turkish banker stated banks perform “extremely meticulous” procedures concerning sanctions, with compliance departments carefully analyzing all transactions.

“This issue is very sensitive and banks’ compliance departments are on top of it,” one other banker stated.

A senior U.S. State Department official informed Reuters it was inspired by stories that Turkish banks are reviewing present business and tightening their compliance applications for Russian purchasers.

“The president’s Dec. 22 amendment to our Russia sanctions authority re-affirmed what we’ve said previously: that foreign financial institutions are responsible for ensuring they do not process transactions that benefit Russia’s military or otherwise enable circumvention of our measures.”

“We have had extensive discussions with our Turkish partners over the last year. We will analyze January trade data once available and look forward to continuing those conversations,” the official stated.

Initial information confirmed Turkish exports to Russia fell 39% year-over-year to $631 million (TL 1.95 billion) in January, having elevated 16.9% final yr to $10.9 billion. Imports from Russia fell 20.2% in January to $4 billion, having dropped 22.5% in 2023 to $45.6 billion.

Crude imports from Russia jumped greater than twofold to 12 million tons in 2022. It equipped 8.9 million tons of oil to Türkiye in January-November 2023, down 20% from the yr earlier than however nonetheless above the pre-war common.

But a lot of the impression was on non-oil commerce, sources stated.

“Exports of machinery, in particular, stopped simply because of the similarity with military equipment,” the primary supply acquainted with the problem stated.

“The real problem arises not with the payment that Türkiye should make, but with the payment that Türkiye will receive. This shows the high level of hesitation Turkish banks have towards sanctions,” the supply stated.

Source: www.dailysabah.com