Türkiye’s central financial institution believes it has accomplished sufficient to tighten financial coverage, the nation’s financial system chief stated on Tuesday, a day after a stronger-than-expected inflation studying led world banks so as to add new rate of interest hike forecasts.

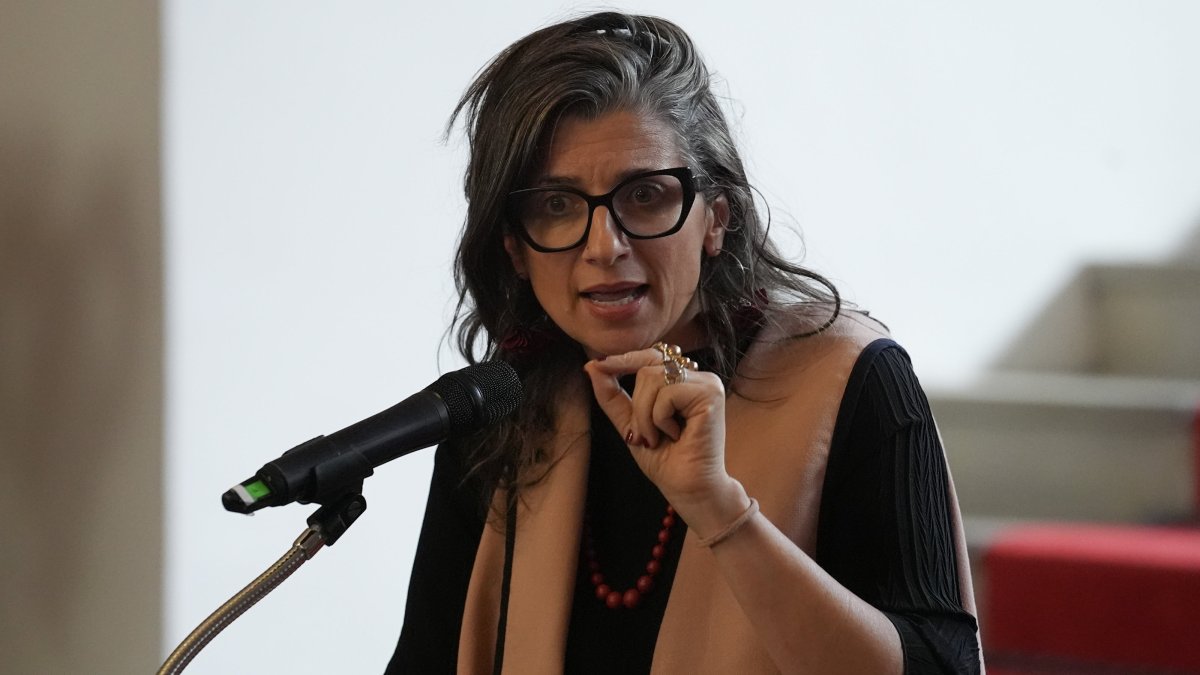

“We think we have done enough, the central bank thinks,” Treasury and Finance Minister Mehmet Şimşek advised a convention in Istanbul.

“We have to be patient and committed going forward,” Şimşek stated.

Official knowledge on Monday confirmed Türkiye’s annual inflation charge climbed to 67.07% in February, exceeding expectations and maintaining the stress for tight financial coverage amid sturdy rises in meals, resort and training costs.

Shortly earlier than the information, Şimşek stated inflation would stay excessive within the coming months as a consequence of base results and the delayed affect of charge hikes however would fall within the subsequent 12 months.

The Central Bank of the Republic of Türkiye (CBRT) has hiked rates of interest by 3,650 foundation factors since June however has now paused its tightening cycle, saying that the present 45% coverage charge is adequate to convey inflation down.

Still, it stated the coverage might be tightened “in case a significant and persistent deterioration in inflation outlook is anticipated.”

Officials have repeatedly stated inflation is envisaged to peak by the center of the yr and enter a steep downward pattern as of the second half of 2024.

Şimşek’s remarks got here after some economists expressed a rising prospect of extra tightening someday after nationwide native elections on March 31, given the worth stress and powerful home demand.

The minister stated authorities had been planning further selective credit score and quantitative tightening steps.

He highlighted that Türkiye was nonetheless in “a transition period” to a disinflation path. “Disinflation will come, (as) monetary policy works, but it works with lags.”

On Monday, JPMorgan added one other 500 foundation level rate of interest hike to their forecasts for the nation in April, a transfer that, if appropriate, would hoist the headline charges to 50%.

The U.S. funding financial institution beforehand anticipated CBRT’s latest hike to be the final of the present cycle.

“Headline CPI inflation came in at 4.5% m/m in February, much higher than our expectation of 4.2% and the market consensus of 3.8%,” JPMorgan stated in a analysis word.

Month-over-month client value inflation (CPI) got here in at 4.53%, down from 6.70% in January however above market forecasts.

Şimşek on Monday stated the federal government’s primary goal was to convey inflation right down to single digits. But, he acknowledged that “currently, we are far from price stability, but that is our target.”

According to Şimşek, inflation “will be back on trend as of March. It will become in line with our disinflation path.”

Last month, the central financial institution maintained its 36% year-end inflation goal and vowed to maintain coverage tight for longer to convey inflation right down to the forecasted path.

However, JPMorgan stored its year-end coverage charge forecast of 45%, saying the central financial institution would possibly minimize its coverage charge in November and December.

Correction in financial coverage

Şimşek is main the brand new financial system administration of technocrats that has delivered aggressive tightening aimed toward arresting inflation, curbing power deficits, rebuilding international change reserves and stabilizing the lira.

After final yr’s common and parliamentary elections, the staff was put in and reversed the yearslong financial easing cycle.

Şimşek on Tuesday stated Türkiye has a program aiming to realize value stability, restore fiscal well being, slim the present account deficit, rebalance development, and implement structural reforms to spice up productiveness and competitiveness.

“There has been a course correction in monetary policy. So we call it monetary policy normalization, which means tightening,” he famous.

The compound rate of interest is at the moment 56%, one yr forward of inflation, which markets anticipate to be roughly about 38%, he famous.

The transition interval will final till this June, adopted by a speedy disinflation interval, Şimşek underlined.

On the nation’s official reserves, he stated they’ve improved considerably since final May.

He additionally stated Türkiye is reviewing expenditures and combating casual financial exercise.

Good infrastructure growth

Saying that Türkiye wants investments in power, fiber optics and the inexperienced transition, Şimşek invited the non-public sector to take part in public-private partnership tasks.

“As the government, we have invested about $258 billion over the past 20 years in infrastructure (and) as the government, we need to invest another $200 billion,” he famous.

He stated that Türkiye has accomplished nicely in highway infrastructure and airports and is constructing a high-speed railway community, wherein it wants to take a position not less than $70 billion over the subsequent 30 years.

“Because that is key to competitiveness, that is also key to sustainability and resilience,” the minister added.

Source: www.dailysabah.com