Inflation within the United States eased barely in April after three elevated readings, in keeping with official knowledge Wednesday that’s prone to provide a tentative sigh of reduction for officers on the Federal Reserve (Fed) in addition to President Joe Biden’s reelection staff.

Consumer costs rose 0.3% from March to April, the Labor Department mentioned, down barely from 0.4% the earlier month. Measured year-over-year, inflation ticked down from 3.5% to three.4%. And a measure of underlying inflation, which excludes unstable meals and vitality prices, fell to the bottom stage in three years.

Inflation had been unexpectedly excessive within the first three months of this 12 months after having steadily dropped within the second half of 2023. The elevated readings had dimmed hopes that the worst bout of inflation in 4 many years was being quickly tamed.

Whether inflation continues its decline might have a major impact on the presidential race. Republican critics of Biden have sought to pin the blame for prime costs on the president and use it to attempt to derail his reelection bid. While hiring stays sturdy and wage development, on common, wholesome, costs stay usually effectively above their pre-pandemic ranges.

Wednesday’s report might present a dose of reassurance that the tempo of value will increase could also be resuming its slowdown. Though the most recent figures present inflation nonetheless effectively above the Fed’s 2% goal stage, it’s the primary time this 12 months that the year-over-year determine has declined. And value will increase cooled in some service industries, akin to accommodations, well being care and auto repairs, that had beforehand saved inflation elevated.

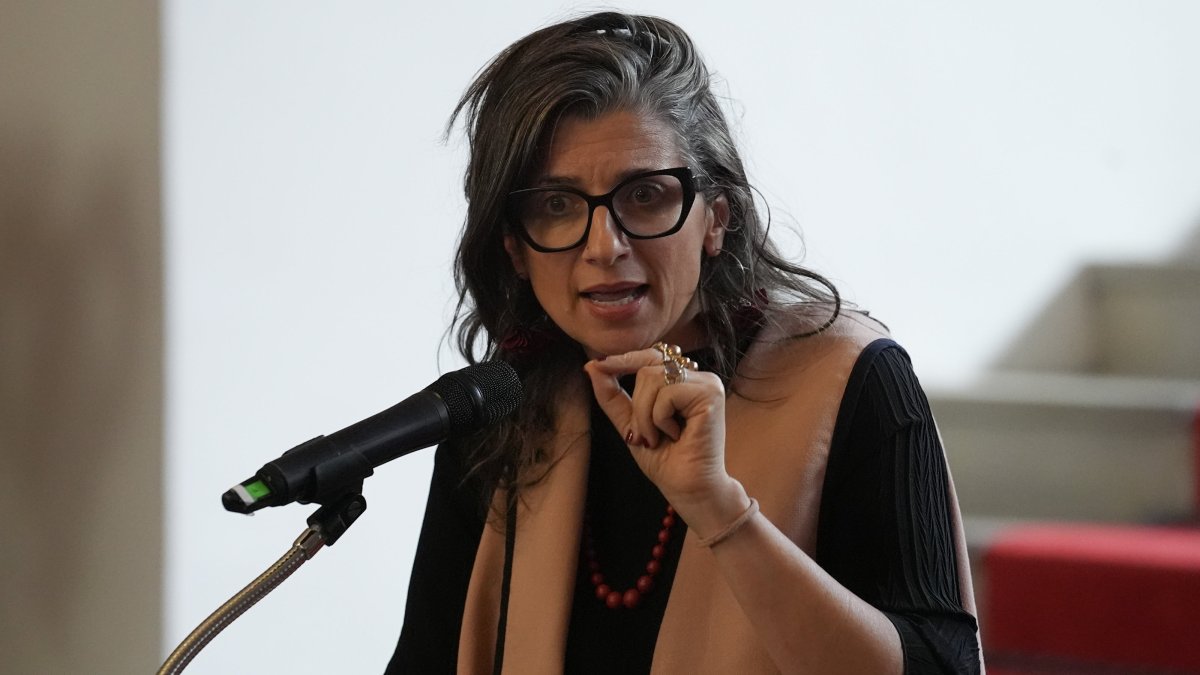

The report “was a tiny step in the right direction,” mentioned Danielle Hale, chief economist at Realtor.com. “The fight against inflation is not yet over, but the worsening trend observed in the first quarter of 2024 may have ended.”

Fed Chair Jerome Powell had responded to the excessive inflation readings earlier this 12 months by dropping his earlier ideas that rate of interest cuts had been seemingly in 2024. Instead, he confused that the Fed’s policymakers want “greater confidence” that inflation is falling to their 2% goal earlier than they would scale back borrowing charges from excessive ranges.

The central financial institution “would like to see probably three that look like this” earlier than contemplating fee cuts, mentioned Jason Pride, chief of funding technique and analysis at Glenmede. That would imply no fee reduce earlier than September on the earliest.

Grocery costs slipped in April, offering a break to consumers. Egg costs, which have been unstable after a bout of avian flu, fell 7.3%. New and used automotive costs additionally dropped. By distinction, costs for gasoline and clothes each jumped.

Excluding unstable meals and vitality prices, so-called core costs rose 0.3% from March to April after three straight months of 0.4% will increase. Measured with a 12 months earlier, core costs elevated 3.6% in April, down from 3.8% in March. The Fed carefully tracks core costs, which have a tendency to offer a greater learn of the place inflation is headed.

Apartment rental costs remained stubbornly excessive, climbing 0.4% from March to April. Average residence rents are 5.4% increased than they had been a 12 months earlier. Rental and different housing prices accounted for two-thirds of the year-over-year improve in core costs.

On Tuesday, Powell reiterated that he nonetheless expects inflation to in the end attain the central financial institution’s 2% goal. But in remarks throughout a panel dialogue in Amsterdam, Powell acknowledged that his confidence in that forecast has weakened after three straight months of elevated value readings. Inflation has fallen sharply from 9.1% in the summertime of 2022 however is increased now than in June 2023, when it first touched 3%.

With 11 fee hikes from March 2022 to July 2023, the Fed’s policymakers raised their key fee to a 23-year excessive of 5.3% in an effort to quell rising costs. Powell underscored Tuesday that the Fed will preserve its fee at that stage for so long as wanted to totally conquer inflation, a sign that fee cuts received’t start as quickly as many individuals had hoped.

Economists are divided over whether or not the excessive inflation figures in latest months replicate a re-acceleration in value development or are merely echoes of pandemic-related value distortions. While auto insurance coverage has soared 22% from a 12 months in the past, for instance, that surge could replicate components particular to the auto trade: New automotive costs jumped throughout the pandemic, and insurance coverage firms are actually searching for to offset the upper restore and substitute prices by elevating premiums.

Stubbornly elevated residence rents are one other key issue behind persistent inflation. Rents soared throughout the pandemic as extra Americans selected to reside alone or sought extra dwelling area. Though rents for brand spanking new leases are rising far more slowly, in line with pre-pandemic patterns, the sooner will increase are nonetheless elevating the federal government’s value knowledge.

Some economists level to regular shopper spending on restaurant meals, journey, and leisure, classes the place, in some circumstances, value will increase have been elevated, seemingly reflecting sturdy demand.

Powell, in his remarks Tuesday, additionally highlighted rising rents as a key issue protecting inflation excessive. He referred to as that “a bit of a puzzle” as a result of measures of latest residence leases present new rents barely rising. Such weaker knowledge has apparently but to move into the federal government’s measures, which cowl all rents, together with for tenants who renew their leases and are dealing with greater will increase. Powell mentioned the federal government’s measures ought to ultimately present lease development easing.

The Fed chair additionally acknowledged that the economic system “is different this time” as a result of so many Americans refinanced their mortgages at very low charges earlier than the Fed started elevating borrowing prices in March 2022. Many giant companies additionally locked in low charges at the moment.

“It may be,” he mentioned, that the Fed’s fee coverage “is hitting the economy not quite as strongly as it would have if those two things were not the case.”

Source: www.dailysabah.com