Healthcare startups in Türkiye are attracting vital funding, significantly on the seed stage. Beyond the Scientific and Technological Research Institution of Türkiye’s (TÜBITAK) BiGG program, Türk Telekom Ventures can be key participant in backing modern ventures.

On a world scale, funding in healthcare startups is projected to exceed $7 billion by the tip of 2024, based on trade estimates.

Total investments in digital well being startups worldwide have been roughly $18 billion in 2023, based on CB Insights. Although that marked a lower in comparison with 2021 and 2022, the sector stays a focus for international buyers.

Projections for 2024 point out continued curiosity, with synthetic intelligence-backed well being startups anticipated to develop by 15%-20%. Investments in telehealth companies are projected to surpass $7 billion by the tip of 2024.

In Türkiye, healthcare startups acquired $20 million–$25 million in investments in 2023, based on trade monitor startups.watch knowledge. Though modest in comparison with international ranges, the range of the startups is noteworthy.

Startups.watch stories that 30% of Türkiye’s healthcare initiatives concentrate on AI and knowledge analytics, emphasizing their modern edge.

Health startups additionally represent an necessary section mong TÜBITAK BiGG investments.

Türk Telekom investments

Türk Telekom’s company enterprise capital firm, TT Ventures, performs a pivotal function by way of its company enterprise capital efforts and a startup accelerator program. These initiatives help scalable, sustainable, and modern healthcare options.

For over a decade, Türk Telekom has performed a number one function within the progress of modern startups by way of its Pilot acceleration program.

Türk Telekom Ventures and TT Ventures VCIF put money into startups specializing in future applied sciences and help their progress within the international market by way of worldwide collaborations.

Türk Telekom Ventures goals to strengthen the entrepreneurial ecosystem and has made vital contributions to varied startups in fields starting from well being to training, productive AI options, picture processing and massive knowledge options.

Among the TT Ventures VCIF investments are Virasoft and Albert Health. Graduates of TT Ventures’ Pilot, Aivisiontech and Hevi AI contribute to digital transformation in well being with AI-supported options for early prognosis, continual illness monitoring and preventive well being approaches, whereas Kidolog supplies on-line professional help in household applied sciences.

Contribution to innovation tradition

Muhammed Özhan, normal supervisor of TT Ventures, says Türk Telekom is among the firms investing essentially the most in know-how in Türkiye and focuses on startups that may strengthen the entrepreneurial ecosystem whereas main the digitalization of many sectors.

“We contribute to developing the entrepreneurship and innovation culture through acceleration programs and investment opportunities we offer startups. We know that developing technologies make a significant difference in health as in every aspect of life,” mentioned Özhan.

“By centering our work around people and the value we can offer, we contribute to digitalization in many fields, including health. We will continue to lead the spread of digital solutions that aim to improve human life and support the global expansion of startups.”

Healthy residing by way of sports activities

Aivisiontech, a know-how firm growing modern AI options in sports activities and well being, presents a system that analyzes thermal photographs of athletes earlier than and after coaching to guage muscle fatigue and damage danger inside 15 seconds.

Solutions offered to sports activities groups supply AI-based help to technical groups, whereas reasonably priced options developed for public hospitals facilitate affected person analysis processes.

Transforming well being companies

Graduating from the TT Ventures’ Pilot program in 2020, Hevi AI presents AI-based options to the well being sector.

Its product portfolio consists of AI-supported options that velocity up diagnostic processes for vital well being issues and enhance diagnostic accuracy, offering straightforward adaptation in international markets.

Hevi AI operates in Azerbaijan, Ukraine, and Bulgaria and goals to enter the Qatari market by 2025. By making its merchandise accessible to public well being, Hevi AI contributes to the digitalization of the well being sector in Türkiye.

AI-supported options in most cancers prognosis

Virasoft focuses on enhancing most cancers prognosis and therapy with AI-supported decision-support algorithms, workflow options, and telepathology platforms.

Supporting the workflow and decision-making processes of pathologists in over 20 establishments with 400,000 instances yearly, the corporate is taking steps in the direction of international enlargement with its headquarters in New York and analysis and improvement (R&D) workforce in Istanbul.

The firm continues demo processes in nations akin to Singapore, Malaysia, Georgia, Qatar and Saudi Arabia.

Tech-backed consulting for folks

Kidolog, a household know-how firm offering on-line help to folks in numerous areas with a multidisciplinary method, presents 24/7 on-line help from verified {and professional} specialists in 10 completely different classes.

Kidolog, with methods authorized by the Ministry of Health and integrations with e-Government, e-Pulse and e-Prescription, has offered companies to households in over 35 nations.

AI-supported voice well being assistant

As a voice well being assistant serving to continual sufferers handle their therapy, Albert Health is named Türkiye’s “first” voice well being assistant.

It reminds customers to take their common drugs and information blood strain, sugar and pulse values, making well being measurements simpler to trace.

The system, which can be utilized by folks of all ages, permits sufferers to report all their well being measurements with voice instructions and share them with their docs or kinfolk.

New-gen fee startups dash towards tremendous app standing

Financial know-how startups, or fintechs, are quickly rising, pushed by latest regulatory selections and are introducing shoppers to quite a few new purposes in fee methods.

Founded in 2020 and targeted on next-generation fee applied sciences, Sipay has made vital strides.

Its CEO, Semih Muşabak, introduced that the corporate’s digital POS system has reached a quantity of TL 25 billion, positioning Sipay on its approach to turning into a brilliant app.

Muşabak additionally expressed the purpose of facilitating TL 200 billion in funds.

“Our flagship ‘Payment Acceptance Systems’ vertical continues to serve with both Physical and Virtual POS. We have achieved a volume of TL 25 billion in the virtual POS segment. We have developed gold trading and credit lending services. Through the Sipay application, users can load and withdraw money, create prepaid cards, transfer money and view balances in other banks,” he famous.

“Additionally, we are part of the FAST system and can create iBans for users, allowing them to perform money loading and transfer operations with their iBan. Users can make payments at any point with a QR Code. Furthermore, we recently introduced a first in Türkiye: users can now access the Findeks Credit Score Risk Report, developed by the Credit Registration Bureau (KKB), with a single click through the Sipay application.”

Providing fee infrastructure

The newest vertical is “Sipay As A Service,” by way of which the corporate supplies infrastructure to unlicensed organizations with its WalletGate and CardGate merchandise, contributing to their fintech transformation, mentioned Muşabak.

“We design the infrastructure of our Digital Wallet and Prepaid Card products for individual users to be used by businesses under their own brands. CardGate is another innovative solution targeting fintech entrepreneurs,” he famous.

By providing Sipay’s personal infrastructure, he mentioned this service helps fintech firms save time and prices, permitting them to launch their monetary know-how merchandise shortly and effectively.

“Although ‘Payment Acceptance Systems’ remains our flagship vertical, we have also achieved significant momentum in our other two verticals,” he added.

Today, the corporate supplies infrastructure for 15,000 member companies and over 4 million particular person customers.

“We are confidently progressing toward becoming a ‘financial super app’ that offers all financial solutions for businesses and individuals from a single point,” mentioned Muşabak.

Growth with investments

Sipay not too long ago secured a $15 million funding in a spherical led by Anfa VC, a world funding firm recognized for its long-term investments and collaboration contributions to entrepreneurs.

“Our investment round attracted significant interest from leading figures in the financial technology sector, including Jitendra Gupta from Citrus Pay and Jupiter, Amrish Rau from Pine Labs, Kunal Shah from CRED, Ravish Naresh from Khatabook and Edward Lando from Pareto Holdings, along with many experienced investors,” Muşabak famous.

Sipay plans to make the most of the funding to develop its product vary, develop modern options, enter new markets and additional strengthen its international presence.

“With this financing, we will accelerate our efforts in artificial intelligence, hyper-personalization, embedded finance, blockchain and virtual reality while also expanding into new markets,” Muşabak mentioned.

Expanding into Europe

He underscored that the corporate goals to increase its success in Türkiye to worldwide markets and obtain fast progress globally.

“Our efforts in Europe, particularly in the United Kingdom, have begun. We aim to complete the POC (Proof of Concept) studies for our products by the end of the year. One of our main agendas for next year is to expand our efforts in the European market, especially in the U.K.,” mentioned Muşabak.

“Our goal for the end of this year is to facilitate TL 200 billion in payments and increase our revenue approximately 3.5 times. Our long-term goal is to become the first financial institution to go public abroad,” he added.

“We aim to reach a billion dollars in revenue within two years and become the first fintech company to go public internationally.”

AI-powered recruitment platform Vinter secures practically $1.5M funding

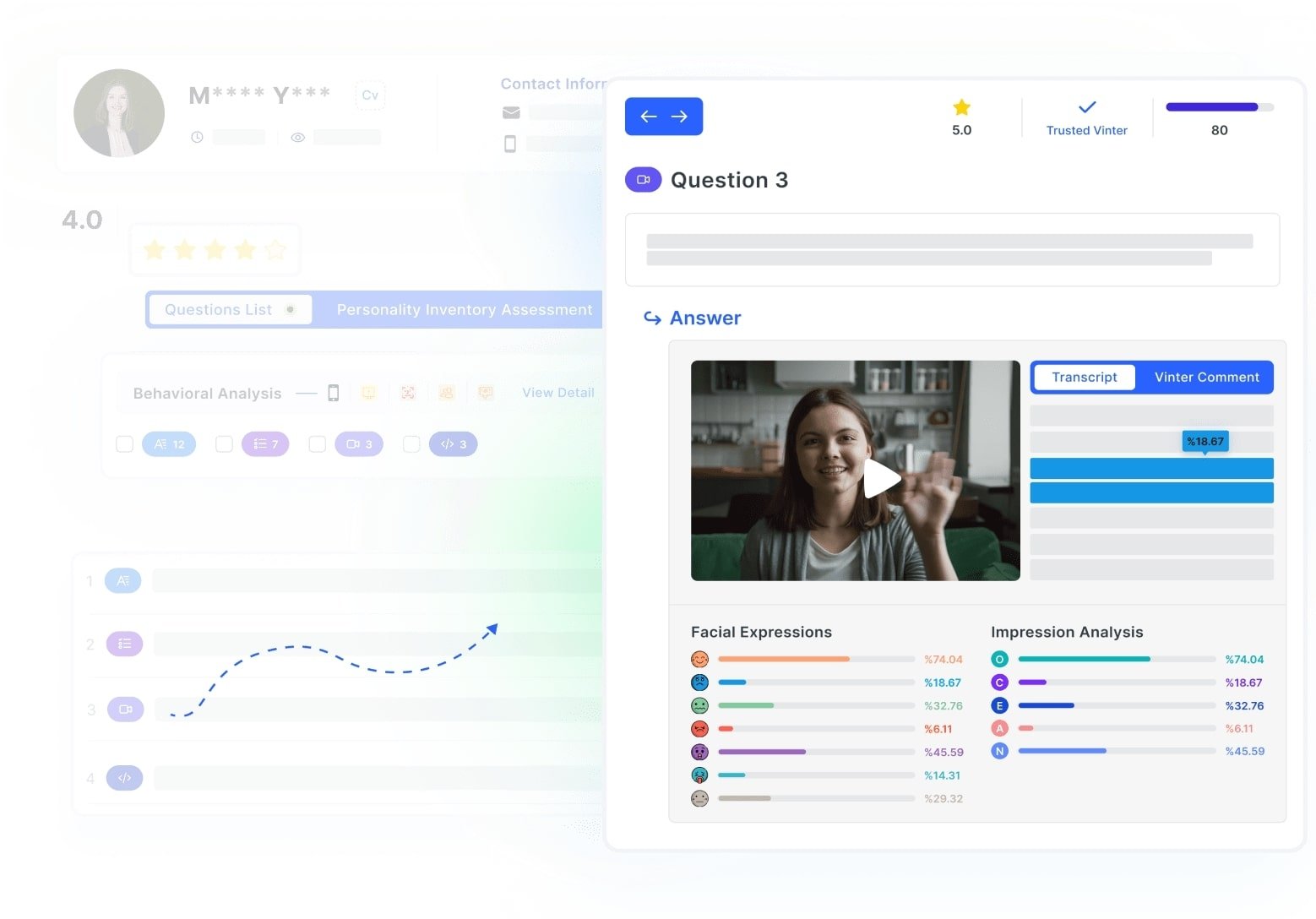

Vinter, an AI-based next-generation recruitment platform that creates a streamlined and clear course of between candidates and recruitment specialists, has secured 1.4 million euros in seed funding from Dutch agency ALCORA B.V.

By growing using AI applied sciences in recruitment processes, Vinter can present companies with recruitment processes which are 9 instances quicker and 80% more cost effective.

Founded in London in 2023, with a analysis and improvement (R&D) heart in Türkiye, Vinter ensures quicker, extra goal, and environment friendly candidate evaluations.

Vinter, favored by main firms within the trade, evaluates and scores candidates based mostly on their responses to questions and suitability for the place. The superior AI analyzes candidates’ competencies intimately, aiming to be the best help for recruiters by offering insights into their selections.

“With Vinter, we conduct a more streamlined and transparent process between candidates and recruitment teams. We offer a flexible infrastructure for recruiters to create their own processes, enabling a data-driven decision-making process,” mentioned Erdem Can, co-founder of Vinter.

“Vinter’s asynchronous process allows candidates and recruitment specialists to manage the process according to their own schedules without the need for meetings or appointments. The system keeps both candidates and recruiters informed of the process progress with status updates,” he famous.

Erkan Yeniçare, chair of the board at Vinter, mentioned the corporate goals to make the most of the funding “to provide businesses worldwide with faster, more efficient, and cost-effective recruitment processes through our AI-supported recruitment platform.”

“We aim to establish a leading position in Türkiye and the global market and to expand the principles of transparency, objectivity, and speed in the recruitment world to a broader user base,” Yeniçare added.

Vinter’s options embrace a versatile construction that enables customization of the recruitment course of, query set administration, technical proficiency, competency stock, overseas language proficiency, dashboards with superior analytics, integrations and AI-supported candidate evaluations.

Source: www.dailysabah.com