Traditional pharmaceutical corporations are more and more turning to synthetic intelligence startups to revolutionize drug growth, considerably lowering each time and prices.

The common price of bringing a brand new drug to market can attain $1.3 billion, and growth occasions can stretch as much as 10-12 years. AI has the potential to chop this time to as little as 12 months whereas additionally slashing prices to a tenth of the standard figures.

AI, significantly generative AI, is enjoying a transformative function within the pharmaceutical {industry}. This know-how accelerates processes from drug design to manufacturing, dramatically reducing prices. The utility of generative AI in drug discovery and growth has turned monthslong processes into weeks, lowering medical trial failures.

CB Insight, which analyzes funding, acquisitions, medical developments, and partnership methods within the pharmaceutical sector, explores how AI reshapes discovery, preclinical, and medical analysis phases in drug analysis and growth (R&D).

From decade to 12 months

Traditionally, bringing a drug to market, factoring in failed trials, prices a mean of $1.3 billion. As effectivity in drug R&D decreases, these prices proceed to rise. AI startups play a vital function in accelerating the drug growth course of.

While conventional drug growth takes 10-12 years, AI purposes have considerably shortened this era. Some AI-driven drug discovery tasks have lowered the transition from designing new compounds to medical trials to as little as 12 months.

Moreover, AI has the potential to lower failure charges in medical trials. Historically, solely 10% of compounds that cross preclinical assessments attain medical trials. AI purposes enhance this share, enabling extra compounds to progress to medical trials.

Investments soar

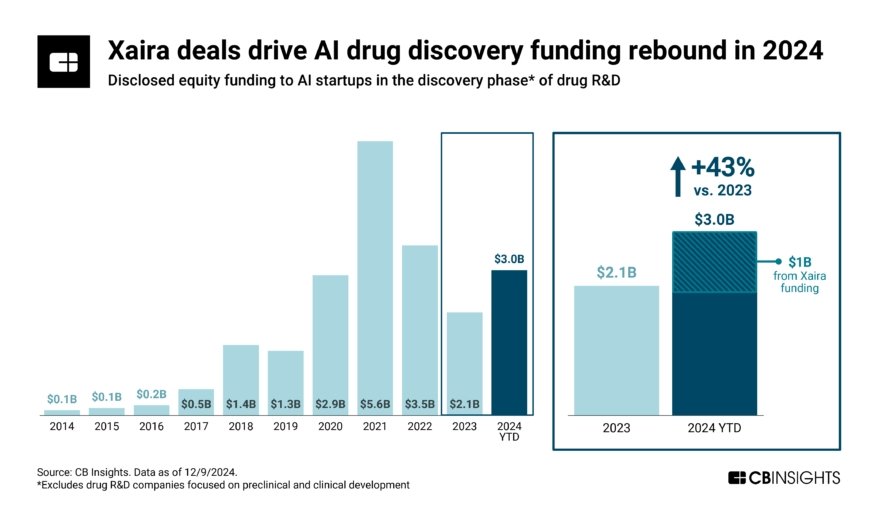

According to CB Insight knowledge, organic drug builders raised $1.6 billion in funding in 2024, greater than double the quantity in 2023. A good portion of this enhance got here from Xaira Therapeutics’ $1 billion funding spherical.

Since 2023, the entire world’s high 10 pharmaceutical corporations have partnered with AI-driven drug discovery startups, with 9 out of the ten additionally creating in-house AI capabilities. For occasion, in 2023, Takeda acquired Nimbus Therapeutics for $4 billion to develop a remedy for plaque psoriasis, the commonest type of psoriasis.

This concentrate on organic medication signifies that AI is increasing from its foundational work with small molecules to bigger, extra computationally complicated therapeutics. AI-driven acquisitions in drug discovery are quickly growing, with eight of the {industry}’s largest 10 offers since 2023.

The whole variety of acquisitions on this interval has doubled the sector’s historic acquisition exercise, reflecting each the maturity of the know-how and the urgency with which main gamers are integrating AI capabilities.

Pharma corporations brace for 3 main adjustments

- Drug discovery course of: Traditionally, the method from drug discovery to advertising takes a mean of 10-12 years. With generative AI purposes, this era is anticipated to fall under one 12 months.

- Cost discount: Drug growth is understood for its excessive prices. Integrating generative AI considerably reduces these prices, making medication extra accessible.

- Increased success charge: In conventional drug growth processes, solely 10% of compounds passing preclinical assessments attain medical trials. The use of generative AI goals to extend these charges, permitting extra compounds to enter medical trials.

Applications of generative AI in pharma

- End-to-end drug sesign: Generative AI is utilized in designing new and biologically lively molecules. For instance, the DSP-1181 molecule was designed utilizing AI and is reported to not have entered medical trials but.

- Protein folding prediction: Predicting the three-dimensional constructions of proteins is a important step in drug design. Generative AI aids on this course of by making extremely correct predictions, serving to establish drug targets.

- Pharmacokinetics and toxicity prediction: Generative AI fashions predict how medication will transfer inside the physique and their potential poisonous results, lowering the danger of failures in medical trials.

Venture capital investments yield excessive returns with profitable startups

Experienced enterprise capital agency 212 has launched its 2024 efficiency analysis, reporting returns exceeding 4 occasions the preliminary investments for its buyers globally and in Türkiye.

Dubbed Türkiye’s first enterprise capital fund, 212 is understood for its strategic investments in notable startups, equivalent to Insider.

212 has bolstered its standing as a formidable participant within the enterprise capital ecosystem via profitable investments and exit offers over the previous 12 months. The fund’s efficiency highlights its robust presence in each native and international markets.

In 2024, 212 achieved greater than quadruple returns for its buyers via key portfolio corporations like Insider. This exceptional efficiency has positioned 212 because the highest-returning VC amongst Türkiye-focused enterprise capital funds.

A notable instance is the acquisition of 123FormBuilder by Silicon Valley-based Kiteworks, marking a major milestone towards the fund’s strategic aims.

Investments in rising tech corporations

Throughout 2024, 212 invested $11.2 million throughout 13 totally different corporations, accelerating the worldwide development of regional tech ventures equivalent to Trio Mobil and SOCRadar.

Trio Mobil’s fourfold valuation enhance and SOCRadar’s tenfold rise in worldwide gross sales exemplify the profitable development tales inside 212’s portfolio.

The fund’s progressive strategy to secondary transactions has supplied liquidity to buyers, enabling them to understand greater than double the returns on their preliminary investments.

This technique has contributed to 212’s rating within the high 10% of world funds primarily based on the paid-in capital distribution a number of.

Diverse financing methods

“Besides supporting startups on their growth journeys, we provided our investors with diverse financing methods,” mentioned 212 co-founder Numan Numan.

“By executing Türkiye’s first secondary transaction, we offered liquidity to our investors, enabling them to achieve cash returns exceeding twice their initial investments. Additionally, we have begun to rank among the top 10% of global funds in terms of paid-in capital distribution multiple,” Numan famous.

‘Boost The Future’ acceleration program wraps up sixth time period

The “Boost The Future” acceleration program, co-organized by Akbank and Endeavor Türkiye and aimed toward empowering the entrepreneurial ecosystem, wrapped up its sixth time period this week with an intensive Demo Day.

During the occasion, 10 startups working in important areas equivalent to sustainability, finance, and power introduced their progressive options to distinguished figures within the ecosystem.

After finishing a rigorous three-month mentorship and coaching program, the ventures showcased their groundbreaking options to an viewers of main ecosystem leaders, buyers, and entrepreneurs.

Strengthening entrepreneurial ecosystem

In her opening remarks, Burcu Civelek Yüce, deputy normal supervisor in command of retail banking and digital options at Akbank and a board member of Endeavor Türkiye, highlighted this system’s achievements.

“We have completed the sixth term of the Boost The Future program, aimed at strengthening the entrepreneurial ecosystem. Through this program, we support future solutions and business models. We provide the necessary guidance and support through the mentorship process to help our entrepreneurs grow and expand internationally,” mentioned Yüce.

“With the Demo Day event, where our ecosystem stakeholders and entrepreneurs came together, we concluded an intense three-month program. We listened to the work of our startups, which create value with the solutions they offer in different verticals,” she added.

“We are proud to play a role in the development of these innovative and impactful startups, which are part of a growing network each year. We will continue to support initiatives that empower the future.”

Petrol Ofisi, Türk Telekom advance co-op with SD-WAN growth

One of Türkiye’s main gasoline distributors, Petrol Ofisi, and the telecommunications and know-how big Türk Telekom introduced on Thursday they’d entered a brand new part of their strategic partnership within the discipline of software-defined vast space community (SD-WAN).

The growth of their collaboration goals to reinforce the administration of gross sales, inventory, and refueling knowledge at gasoline stations and village pumps nationwide, making these processes safer and seamless, the businesses mentioned in a press release.

This venture, spanning 2,700 gasoline stations throughout all 81 provinces of Türkiye, marks a major milestone within the digital transformation of the gasoline {industry}.

Expanding complete partnership

Through this collaboration, Türk Telekom will implement and handle the SD-WAN and Local Network Infrastructure for Petrol Ofisi’s gasoline automation methods, offering industry-standard digital transformation for the following 5 years.

The new settlement additionally extends using SD-WAN know-how, first adopted 4 years in the past in collaboration with Türk Telekom, to BP stations and repair factors that Petrol Ofisi just lately acquired.

Reaching community of two,700 stations

Petrol Ofisi Group CEO Mehmet Abbasoğlu expressed his satisfaction with the venture, which he says is a milestone in attaining their digital transformation objectives and contributes to strengthening the communication automation infrastructure within the power sector throughout Türkiye, together with National Vehicle Recognition System (UTTS), with progressive options.

“We are pleased to implement it with Türk Telekom, a crucial player in Türkiye’s digital transformation. With the acquisition of BP, we now operate a network of 2,700 stations nationwide, reinforcing our role in ensuring the security and accessibility of the country’s energy supply,” mentioned Abbasoğlu.

“We are proud to lead the industry in setting a standard with a secure, uninterrupted, and highly accessible communication infrastructure.”

Flexibility, scalability, velocity

For his half, Türk Telekom CEO Ümit Önal highlighted the significance of the partnership and mentioned his firm is proud to assist companies and establishments on their digital transformation journeys.

“Our vision for digitalization spans various sectors, including defense, industry, finance, energy, education, health care, transportation, agriculture, arts, and sports. The collaboration with Petrol Ofisi, using our SD-WAN technology, enables them to make their network management more flexible, reliable, and centralized, maximizing their operational efficiency,” mentioned Önal.

“We will continue to support digital transformation processes and provide end-to-end solutions with the latest technologies.”

Source: www.dailysabah.com