US President Donald Trump‘s sweeping reciprocal tariffs, which he introduced on Wednesday as a “Declaration of Economic Independence,” will usher in a brand new period in international commerce whereas fueling inflation and recession considerations for the US financial system.

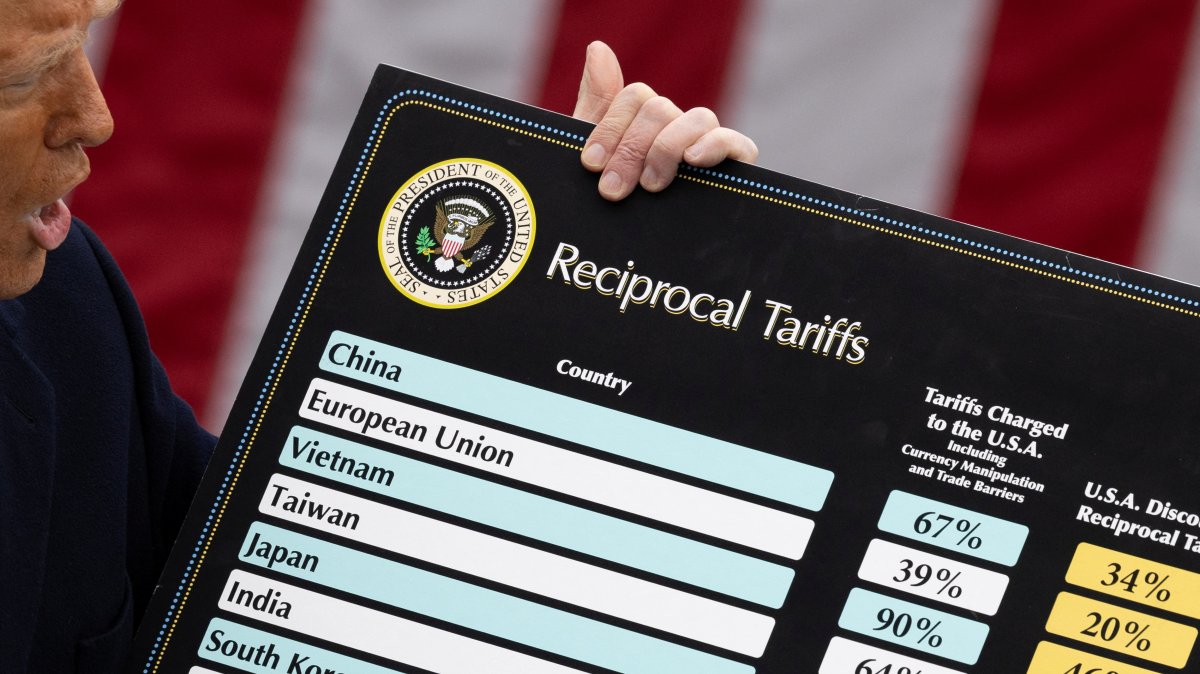

Trump signed an govt order to impose sweeping reciprocal tariffs on over 180 nations, starting from 10% to 50%, to place an finish to commerce practices his administration discovered to have been unfair.

The Trump administration goals to generate almost $700 billion through these extra tariffs to finance tax cuts for the wealthy, however economists warn that these will end in larger import prices and lift costs for finish customers whereas hindering financial development.

Trump claimed the US is being “ripped off” by all nations, pal or foe, and aimed to revitalize home manufacturing and cut back overseas dependence through these tariffs. The President signed govt orders to impose tariffs on the auto, metal, and aluminum sectors and tariffs on Canada, Mexico, and China on account of alleged fentanyl trafficking and the influx of undocumented migrants into the US.

The president pointed to nations which have overseas commerce deficits with the US, suggesting that they don’t purchase sufficient American-made merchandise. US imports reached $4.1 trillion, and exports totaled $3.2 trillion final yr, in accordance with the Department of Commerce.

The EU obtained 20%, China 34%, Vietnam 46%, Taiwan 32%, Japan 24%, India 26%, South Korea 25%, Thailand 36%, Switzerland 31%, Indonesia 32%, Malaysia 24%,

Cambodia 49%, South Africa 30%, Bangladesh 30%, and Israel 17% in reciprocal tariffs.

Some nations, comparable to Türkiye, the UK, Brazil, Australia, the United Arab Emirates, New Zealand, Egypt, and Saudi Arabia, have been subjected to 10% reciprocal tariffs every.

Surprisingly, among the world’s most sanctioned nations, particularly Russia, Cuba, Belarus, and the Democratic Republic of Korea, weren’t subjected to reciprocal tariffs, whereas the uninhabited Heard and McDonald Islands of Australia have been included.

COST, IMPACT OF TARIFFS

The Budget Lab at Yale estimates that tariffs will trigger inflation to rise and price a median of $3,800 per family within the US.

Anderson Economic Group estimates that Trump’s 25% auto tariffs will add $2,500 to $5,000 on the lowest-cost American automobiles and as much as $20,000 on some imported fashions. The estimated price of the auto tariffs on finish customers within the US is $30 billion for the primary full yr.

Meanwhile, US inflation was final recorded as 0.2% on a month-to-month foundation and a pair of.8% on an annual foundation in February.

According to the Boston Fed, the affect of tariffs on US inflation is anticipated to trigger a 1.4 to 2.2 proportion level improve, additional limiting the Fed’s capability to fight inflation.

Consumer confidence within the US has declined since Trump took workplace on Jan. 20, with the University of Michigan’s shopper confidence index reaching its lowest level since Nov. 2022 at 57.9, whereas short-term shopper inflation expectations rose to 4.9%, the best stage because the similar time.

As for financial development, Fitch Ratings estimated that the US will develop slower than the 1.7% projected charge in March as a result of tariffs, whereas Oxford Economics tasks 1.4% development this yr.

The Department of Commerce mentioned the US financial system grew 2.8% final yr, marking a stark distinction in development projections for this yr since Trump’s second time period started in January.

Washington-based assume tank Tax Foundation’s evaluation confirmed that Trump’s tariffs are anticipated to generate $3.2 trillion over the following decade however end in a lack of 0.8% within the nation’s gross home product (GDP).

Source: www.anews.com.tr