The United States and China, as the highest international financial powers, collectively contribute over 40% to the manufacturing of the world’s items and providers.

So when Washington and Beijing do an financial battle, as they’ve for 5 years operating, the remainder of the world suffers, too. And once they maintain a uncommon high-level summit, as Presidents Joe Biden and Xi Jinping will this week, it may have international penalties.

The world’s economic system might certainly profit from a U.S.-China détente. Since 2020, it has suffered one disaster after one other – the COVID-19 pandemic, hovering inflation, surging rates of interest, conflicts in Ukraine and now Gaza. The international economic system is anticipated to develop a lackluster 3% this 12 months and a pair of.9% in 2024, in line with the International Monetary Fund (IMF).

“Having the world’s two largest economies at loggerheads at such a fraught moment,” mentioned Eswar Prasad, senior professor of commerce coverage at Cornell University, “exacerbates the negative impact of various geopolitical shocks that have hit the world economy.”

Hopes have risen that Washington and Beijing can no less than cool a few of their financial tensions on the Asia-Pacific Economic Cooperation (APEC) summit, which begins Sunday in San Francisco. The assembly will carry collectively 21 Pacific Rim international locations, which collectively signify 40% of the world’s folks and almost half of world commerce.

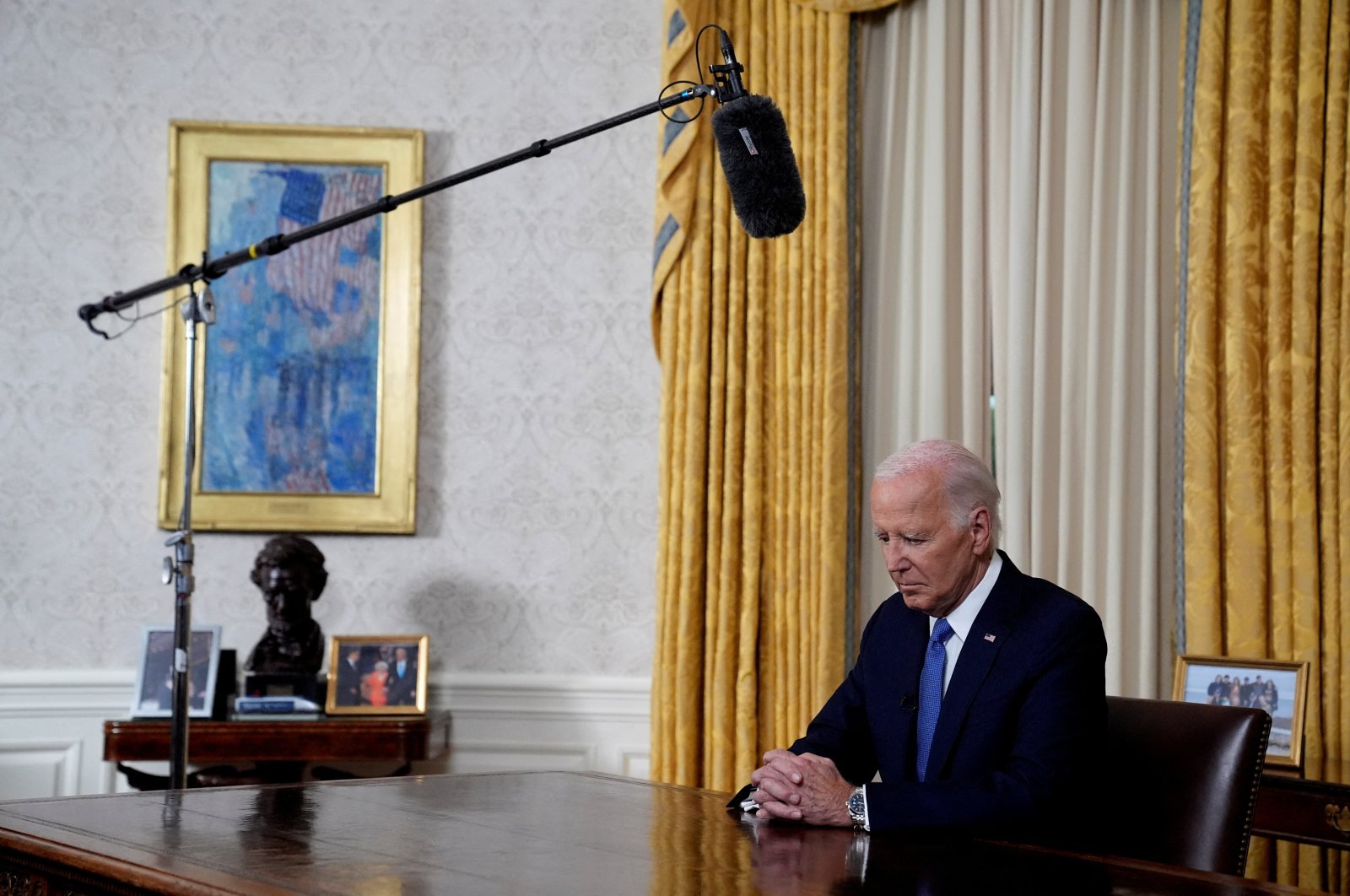

The marquee occasion would be the Biden-Xi assembly on Wednesday on the sidelines of the summit, the primary time the 2 leaders can have spoken in a 12 months, throughout which era frictions between the 2 nations have worsened. The White House has sought to tamp down expectations, saying to anticipate no breakthroughs.

At the identical time, Prasad urged that the brink for declaring a profitable final result is comparatively low. “Preventing any further deterioration in the bilateral economic relationship,” he mentioned, “would already be a victory for both sides.”

The U.S.-China financial relationship had been deteriorating for years earlier than it erupted in 2018 into an all-out commerce conflict on the instigation of President Donald Trump. The Trump administration charged that China had violated its commitments in becoming a member of the World Trade Organization (WTO) in 2001 to open its huge market to U.S. and different international corporations that needed to promote their items and providers there.

In 2018, the Trump administration started imposing tariffs on Chinese imports to punish Beijing for its actions in making an attempt to supplant U.S. technological supremacy.

When Biden took workplace in 2021, he saved a lot of Trump’s aggressive commerce coverage, together with the China tariffs. The U.S. tax price on Chinese imports now exceeds 19%, versus 3% at first of 2018, earlier than Trump imposed his tariffs. Likewise, Chinese import taxes on U.S. items are as much as 21%, from 8% earlier than the commerce conflict started, in line with calculations by Chad Bown of the Peterson Institute for International Economics.

One of the tenets of Biden’s financial coverage has been to scale back America’s financial reliance on Chinese factories, which got here beneath pressure when COVID-19 disrupted international provide chains, and to solidify partnerships with different Asian nations. As a part of that coverage, the Biden administration final 12 months solid the Indo-Pacific Economic Framework for Prosperity with 14 international locations.

In some methods, U.S.-China commerce tensions are even increased beneath Biden than Trump. Beijing is seething over the Biden administration’s resolution to impose – after which broaden – export controls which might be designed to stop China from buying superior laptop chips and the tools to supply them. In August, Beijing countered with its personal commerce curbs: It started requiring that Chinese exporters of gallium and germanium, metals utilized in laptop chips and photo voltaic cells, get hold of authorities licenses to ship these metals abroad.

Beijing has additionally taken aggressive actions towards international corporations in China. Orchestrating what seems to be a counterespionage marketing campaign, its authorities this 12 months raided the Chinese places of work of the U.S. consulting companies Capvision and the Mintz Group, questioned Shanghai staff of the Bain & Co. consultancy and introduced a safety overview of the chipmaker Micron.

Some analysts converse of a “decoupling” of the world’s two greatest economies after many years during which they relied intensely on one another for commerce. Indeed, imports of Chinese items to the U.S. have been down 24% by September in contrast with the identical interval of 2022.

The rift between Beijing and Washington has compelled many different international locations into a fragile predicament: Deciding which aspect they’re on once they truly need to do business with each international locations.

The IMF says such financial “fragmentation” is damaging to the world. The 190-country lending company estimates that increased commerce boundaries will subtract $7.4 trillion from international financial output after the world has adjusted to the upper commerce boundaries.

And these boundaries are rising: Last 12 months, the IMF mentioned, international locations imposed almost 3,000 new restrictions on commerce, up from fewer than 1,000 in 2019. The company foresees worldwide commerce rising simply 0.9% this 12 months and three.5% in 2024 – down sharply from the 2000-2019 annual common of 4.9%.

The Biden administration insists it isn’t making an attempt to undermine China’s economic system. On Friday, Treasury Secretary Janet Yellen met along with her Chinese counterpart, Vice Premier He Lifeng, in San Francisco and sought to set the stage for the Biden-Xi summit.

“Our mutual desire – both China and the United States – is to create a level playing field and ongoing, meaningful and mutually beneficial economic relations,” Yellen mentioned.

Xi, too, has purpose to attempt to restore financial cooperation with the U.S. The Chinese economic system is beneath heavy pressure. Its actual property market has collapsed, youth unemployment is rampant and client spirits are low. The raids on international companies have spooked worldwide corporations and traders.

“With serious headwinds facing the Chinese economy and many U.S. firms packing up their bags and leaving China, Xi needs to convince investors that China is still a profitable place to conduct business,” mentioned Wendy Cutler, vice chairman of the Asia Society Institute and a former U.S. commerce negotiator. “This will not be an easy sell.”

U.S.-China tensions might intensify subsequent 12 months with presidential elections in Taiwan and the U.S., the place criticism of Beijing is among the many few areas that unite Democrats and Republicans.

Xi’s insurance policies seem like costing China within the battle for world opinion. In a current survey of individuals in 24 international locations, the Pew Research Center reported that the U.S. was considered extra favorably than China in all however two (Kenya and Nigeria) nations.

Changing course?

Speaking on the Center for Strategic and International Studies suppose tank in Washington, Rep. Raja Krishnamoorthi, an Illinois Democrat who serves on a House committee that displays China, famous optimistically that Xi has reversed himself earlier than – notably in declaring a sudden finish to the draconian zero-COVID insurance policies that crippled China’s economic system final 12 months.

“We have to give that possibility a chance, even at the same time that we hedge and protect our interests,” Krishnamoorthi mentioned. “That’s what I’m hoping we also see come out of this meeting.”

Source: www.dailysabah.com